Table of Contents

In today’s world, with the rising tide of inflation and the increasing cost of living, many people find it challenging to manage their finances effectively. Unexpected expenses, tight budgets, and the struggle to make ends meet are common issues faced by millions. As a result, there is a growing need for accessible and reliable financial solutions that can help individuals navigate these tough times.

This is where apps like MoneyLion come into play. These innovative financial tools offer a lifeline to those in need by providing services such as cash advances, credit building, budgeting tools, and more. Whether it is accessing a small loan to cover an emergency expense, tracking your spending, or finding ways to save more effectively, these apps are designed to offer the financial support that many people need in today’s economic climate.

Many businesses are looking for mobile app development companies to create innovative apps similar to the MoneyLine app. Moreover, If you are one of the many people looking for alternative financial solutions and are interested in exploring more apps like MoneyLion, this blog is for you. Here are some of the best options available that can help you take control of your finances, improve your credit, and achieve greater financial stability.

What is a MoneyLion App and How Does it Work?

MoneyLion is an instant cash app designed to offer a range of tools and resources to help users manage their finances, improve their credit, and access financial products. MoneyLion aims to provide a comprehensive suite of financial tools in one app, making it easier for users to manage their money, access credit, and work towards long-term financial health.

Key Features

MoneyLion app has several key features which are as follows.

- Mobile Banking:

MoneyLion provides a digital bank account with no hidden fees, offering users features like direct deposit, bill pay, and a free debit card. Users can manage their money, track spending, and set up savings goals directly through the app.

- Instacash:

MoneyLion’s Instacash feature allows users to access cash advances with no interest or fees, based on their expected income. Users can borrow up to a certain amount, typically between $25 and $250, and pay it back with their next paycheck. This service is designed to help users cover short-term financial needs without resorting to high-interest payday loans.

- Credit Builder Plus:

This feature offers users access to small credit-builder loans while helping them build or improve their credit score. The loan repayments are reported to credit bureaus, allowing users to establish a positive payment history. Users also get access to credit monitoring tools to keep track of their credit progress.

- Investment Accounts:

MoneyLion offers managed investment accounts that allow users to invest in diversified portfolios with no minimum balance requirements. The app provides automated investment services, making it easy for users to start investing even with small amounts of money.

- Financial Tracking and Insights:

The app includes budgeting tools and personalized financial insights to help users track their spending and savings. Users can link external accounts to get a complete view of their financial situation and receive recommendations to improve their financial health.

How It Works

Users start by downloading the MoneyLion app and signing up for an account. Once set up, they can access the various features according to their needs. For instance, users can:

- Open a bank account for everyday transactions and budgeting.

- Apply for Instacash advances to cover immediate financial needs.

- Track their finances, set up goals, and receive insights to improve their financial habits.

Similar Apps Like MoneyLion

-

Chime

Chime is an app like MoneyLion that offers a full-service bank account without hidden fees. Chime focuses on automating savings with features like “Save When You Get Paid,” which automatically transfers a percentage of direct deposits to savings, and “Round Up,” which rounds up transactions to the nearest dollar and transfers the difference into your savings.

Android App Rating: 4.6

iOS App Rating: 4.8

Pros:

- No hidden fees or minimum balance requirements.

- Automatic savings features.

- Access to a large ATM network.

Cons:

- No physical bank branches.

- Limited account types (no joint accounts).

- Cash deposits can be inconvenient.

-

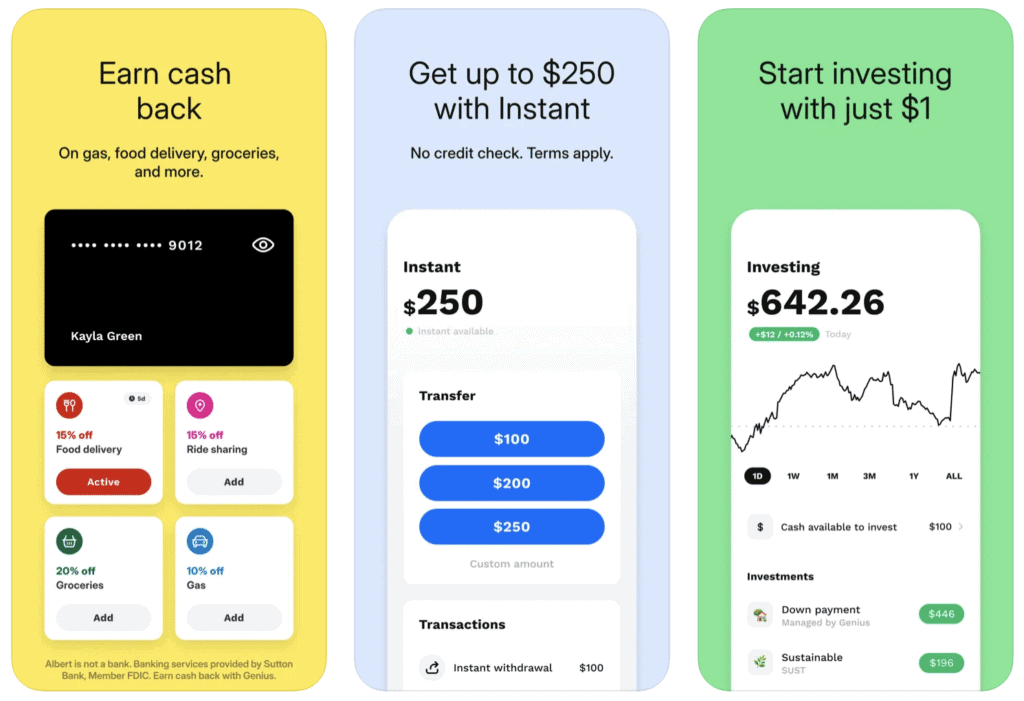

Albert

Albert is a personal finance and banking app that combines traditional banking services with intelligent budgeting and saving tools. It is one of the other apps like MoneyLion which analyzes your income and spending habits to recommend a personalized budget. Also, Albert provides cash advances, instant savings bonuses, and human financial advisors to help users make informed decisions.

Android App Rating: 4.2

iOS App Rating: 4.6

Pros:

- Personalized budgeting recommendations.

- Automatic savings adapted to spending habits.

- Access to human financial advisors.

Cons:

- Some features require a subscription.

- Limited investment options.

- Cash advances are capped.

-

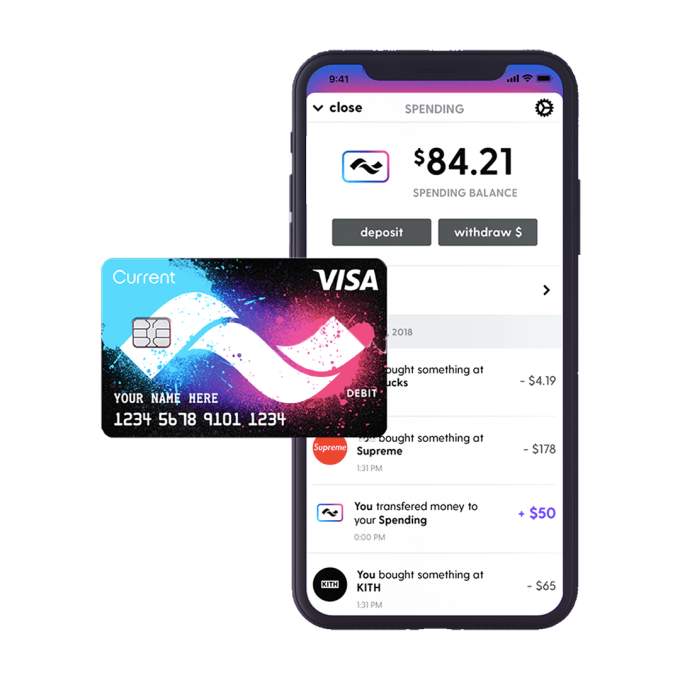

Current

Current is a mobile banking app designed to provide users with faster access to their paychecks, budgeting tools, and spending insights. Current offers a Premium account that allows direct deposits to arrive up to two days faster, and it includes features like fee-free overdrafts and instant gas hold refunds.

Android App Rating: 4.5

iOS App Rating: 4.7

Pros:

- Early direct deposit (up to two days faster).

- Fee-free overdrafts.

- Instant gas holds refunds.

Cons:

- Premium account required for full features.

- No interest on checking accounts.

- Limited physical deposit options.

-

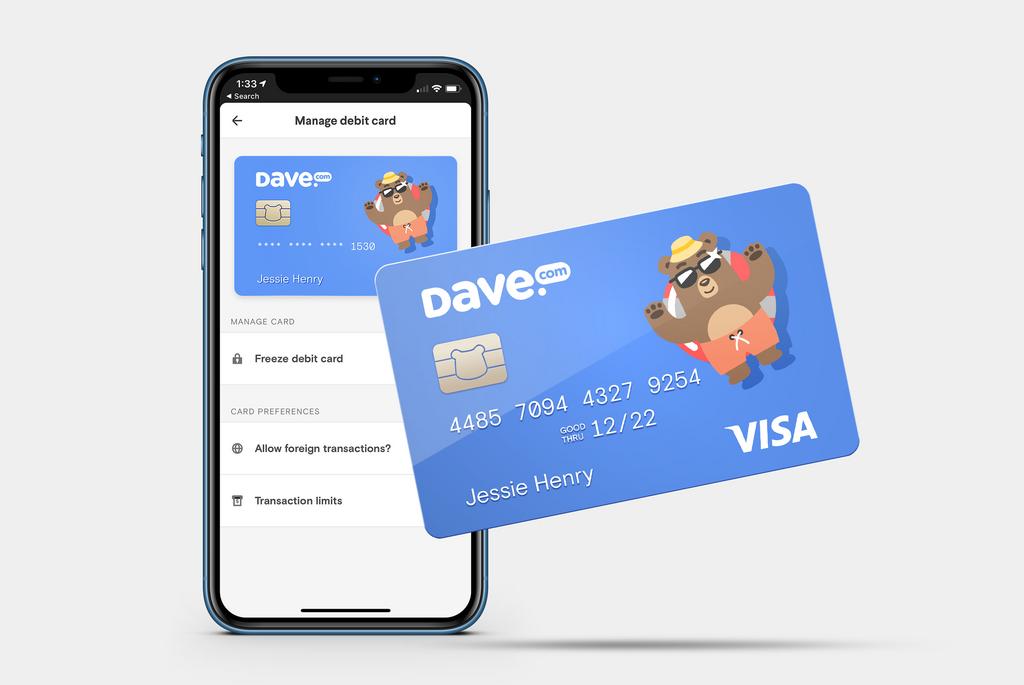

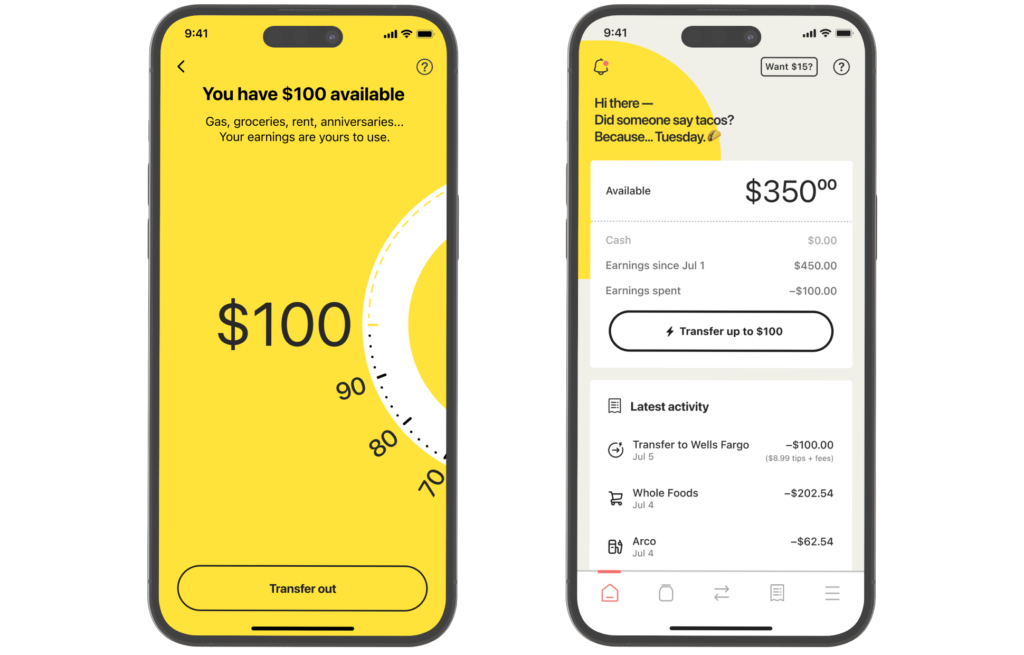

Dave

Dave is a financial app that helps users avoid overdraft fees by offering small, interest-free cash advances up to $500 until their next paycheck. It is one of the cash advance apps like MoneyLion which includes budgeting tools that analyze users’ spending habits and predict upcoming expenses, helping them avoid overdrafts.

Android App Rating: 4.2

iOS App Rating: 4.7

Pros:

- Interest-free cash advances.

- Budgeting tools with predictive analytics.

- “Side Hustle” feature for extra income.

Cons:

- Requires a subscription for certain features.

- Cash advances have a low limit.

- No investment or savings options.

-

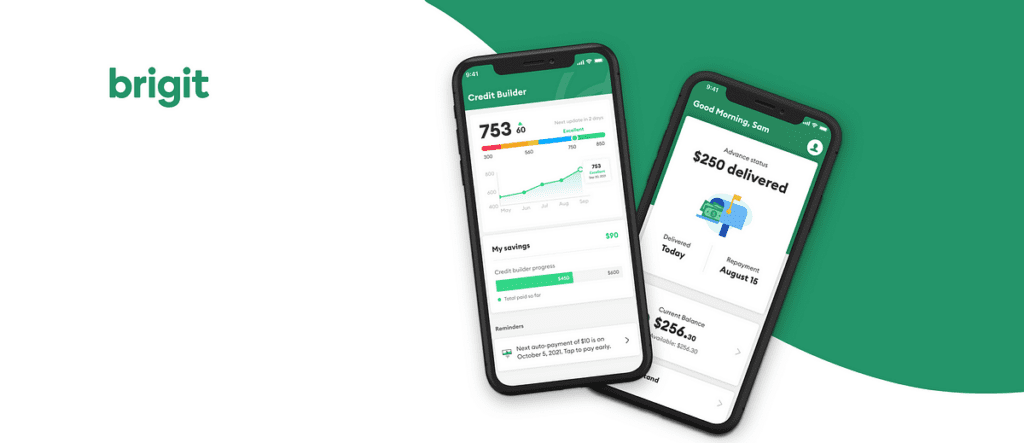

Brigit

Brigit is an app which provides users with financial security by offering cash advances. Brigit users can receive cash advances of up to $250 to avoid overdraft fees, and the app offers a budgeting tool that tracks income and expenses. It also monitors users’ bank accounts to predict low balances and automatically advances money if needed. Brigit doesn’t charge late fees or interest, making it a straightforward alternative to payday loans.

Android App Rating: 4.5

iOS App Rating: 4.8

Pros:

- Automatic cash advances to prevent overdrafts.

- No interest or late fees on advances.

- Budgeting tools with real-time insights.

Cons:

- Limited to U.S. residents.

- Subscription required for premium features.

- No banking or investment services.

-

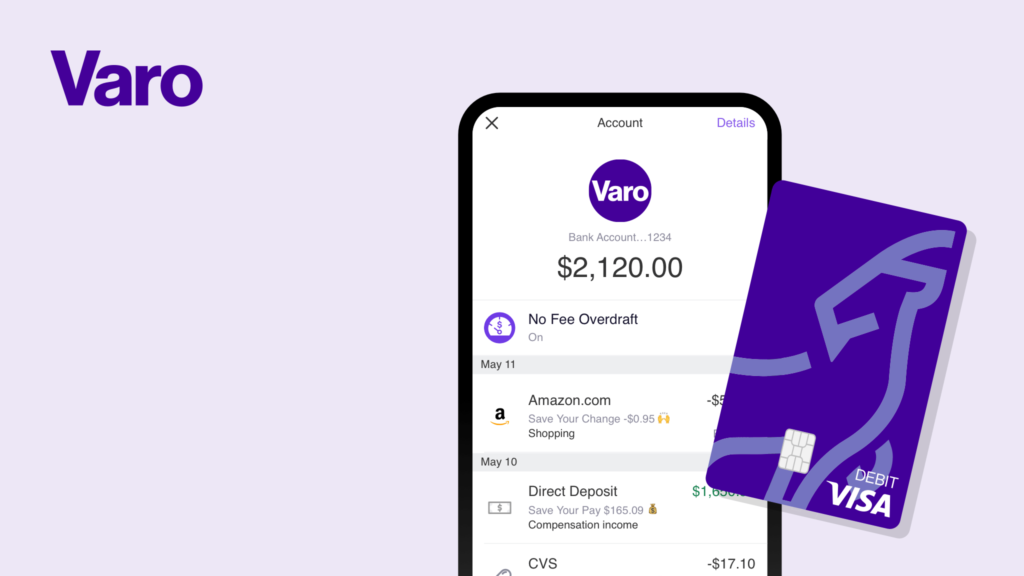

Varo

Varo is a mobile app like MoneyLion offering checking and savings accounts with no monthly fees, no overdraft fees, and access to over 55,000 ATMs nationwide. Varo also provides early direct deposit, allowing users to access their paychecks up to two days early.

Android App Rating: 4.6

iOS App Rating: 4.7

Pros:

- No monthly fees or overdraft fees.

- High-yield savings account.

- Early access to direct deposits.

Cons:

- Limited physical branch access.

- Some features require account balances.

- No cash-back or rewards programs.

-

Earnin

Earnin is one of the apps like MoneyLion instant cash that allows users to access their earned wages before payday without fees or interest. Users can connect their bank accounts, and the app tracks their work hours to determine how much they’ve earned. Users can then cash out a portion of their earnings, which will be deducted from their next paycheck.

Android App Rating: 4.3

iOS App Rating: 4.7

Pros:

- Access earned wages before payday.

- No fees or interest on cash advances.

- “Balance Shield” feature to avoid overdrafts.

Cons:

- Limited to hourly or salaried employees.

- Requires consistent paycheck deposits.

- Advances are limited by work hours.

-

SoFi

SoFi is a finance app that offers a range of services, including personal loans, student loan refinancing, mortgages, and investment options. Its mobile banking services include a high-yield checking and savings account with no account fees.

Android App Rating: 4.2

iOS App Rating: 4.8

Pros:

- Wide range of financial services (loans, investments).

- No account fees.

- Access to financial advisors.

Cons:

- No physical bank branches.

- Some services have higher requirements.

- Limited cash deposit options.

-

-

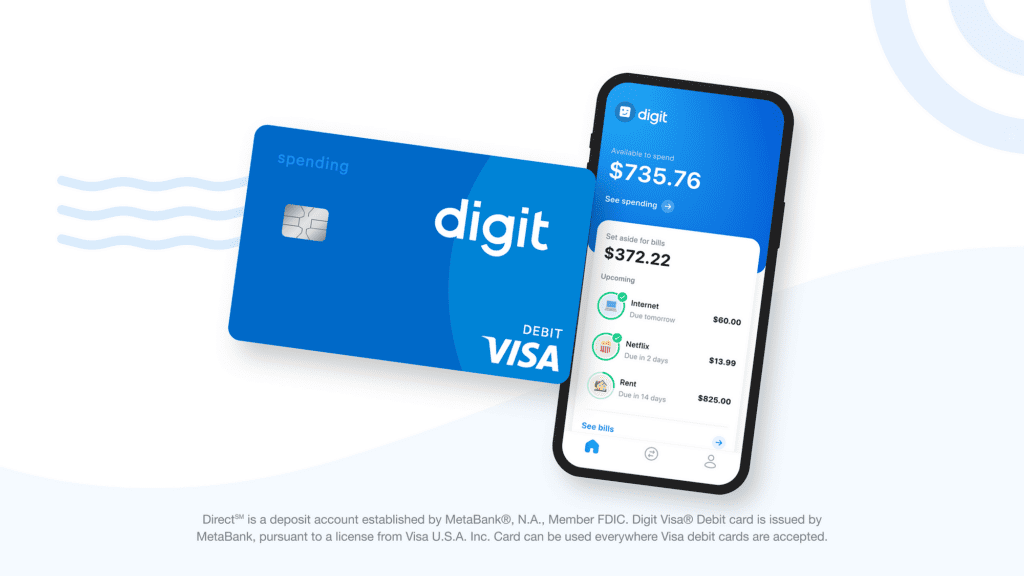

Digit

-

Digit is a savings app that uses AI to analyze your spending habits and automatically save money for you. The app links to your checking account and transfers small amounts to your Digit savings account based on your income and spending patterns. Users can set specific savings goals, such as vacations or emergency funds, and Digit will allocate funds accordingly.

Android: 4.4

iOS: 4.7

Pros:

- Automatic savings based on spending habits.

- Customizable savings goals.

- Credit card debt payoff feature.

Cons:

- Subscription required after a free trial.

- Savings transfers may be too conservative for some users.

- Limited banking features.

-

Aspiration

Aspiration is one of the apps like MoneyLion that focuses on ethical banking and investing. It offers a Spend & Save account with a high-interest savings option and a debit card that earns cash back on socially responsible purchases. Aspiration allows users to pay what they think is fair in fees, and it donates a portion of its profits to charity.

Android App Rating: 4.3

iOS App Rating: 4.8

Pros:

- Ethical banking and investment options.

- Pay-what-you-want fee structure.

- Cash back on socially responsible purchases.

Cons:

- Limited ATM access.

- Ethical investing may limit returns.

- No physical bank branches.

-

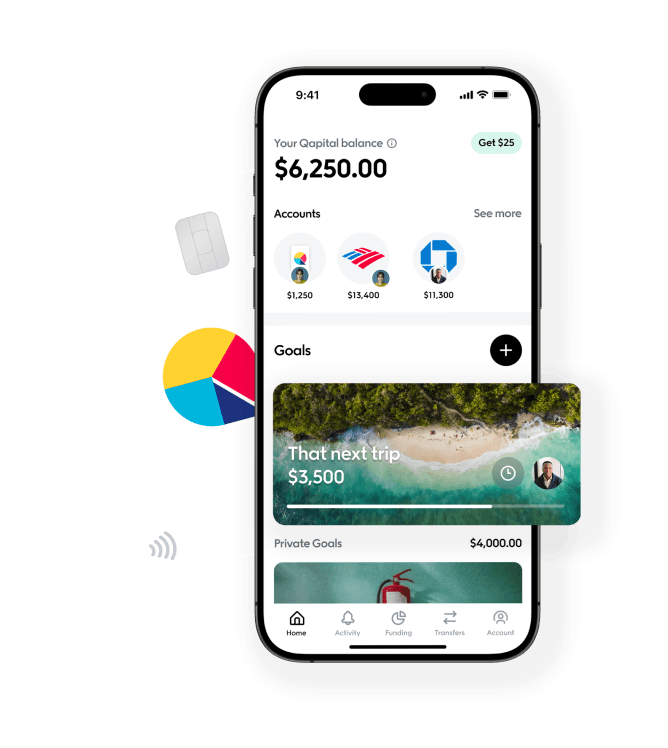

Qapital

Qapital is a personal finance app that helps users save money through goal-based savings and automation. Users can set specific financial goals, like saving for a vacation or a down payment, and Qapital will round up everyday purchases to the nearest dollar, transferring the difference to a savings account. Moreover, Qapital provides a budgeting tool and the ability to invest savings into diversified portfolios.

Android App Rating: 4.4

iOS App Rating: 4.7

Pros:

- Goal-based savings with customizable rules.

- Automated savings through purchase round-ups.

- Budgeting and investment options.

Cons:

- Subscription required for full features.

- No traditional banking services.

- Limited investment options.

-

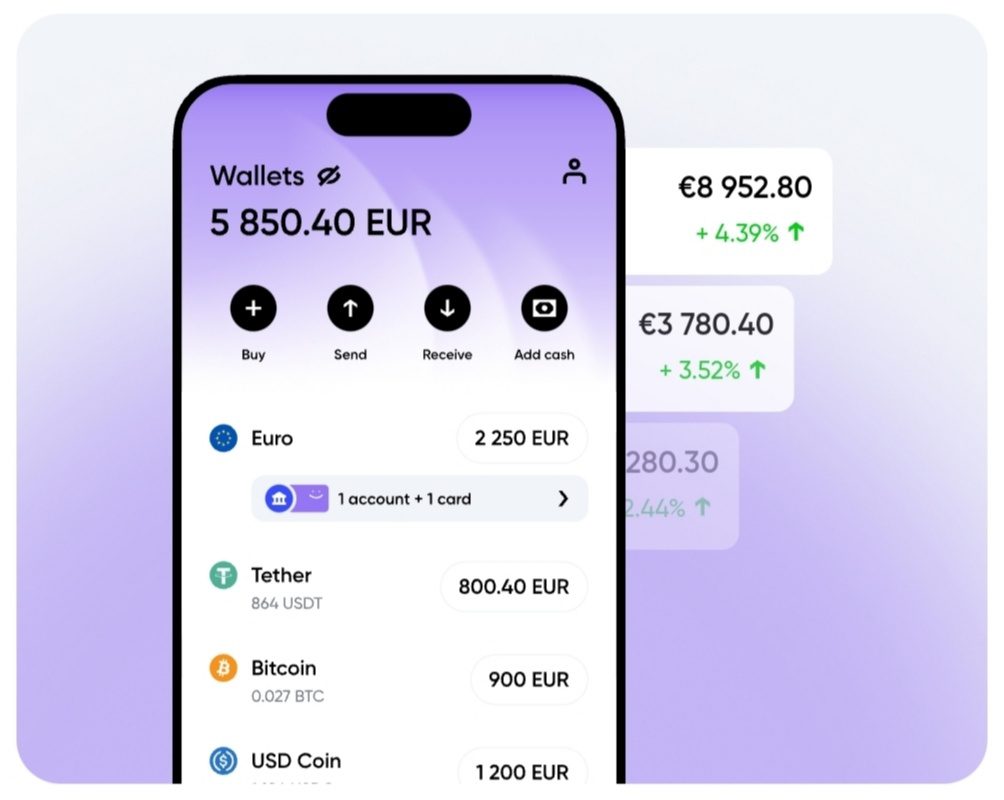

N26

N26 is a MoneyLion similar app that offers a streamlined, fee-free banking experience. N26 features include instant notifications for transactions, easy money transfers, and budgeting tools to track spending. The app is known for its intuitive design and the ability to create sub-accounts, called “Spaces,” to organize savings for different goals.

Android App Rating: 4.6

iOS App Rating: 4.7

Pros:

- Fee-free international transactions.

- Instant notifications for transactions.

- Sub-accounts (“Spaces”) for savings goals.

Cons:

- Limited U.S. availability.

- No physical branches.

- Basic account has limited features.

-

Stash

Stash is a personal finance application that integrates banking, investment options, and financial literacy resources. Users can start investing with as little as $5, choosing from a wide range of ETFs and individual stocks. The app also offers personalized advice and educational content to help users build a diversified portfolio.

Android App Rating: 4.2

iOS App Rating: 4.7

Pros:

- Easy entry into investing with small amounts.

- Personalized investment advice.

- Stock rewards with everyday purchases.

Cons:

- Subscription required for some features.

- Limited investment options.

- No interest on cash balances.

-

Acorns

Acorns is an investment app that automatically invests users’ spare change from everyday purchases. By linking a debit or credit card, Acorns rounds up transactions to the nearest dollar and invests the difference in a diversified portfolio. The app also offers a range of investment options based on risk tolerance, along with tools for retirement savings, family accounts, and socially responsible investing.

Android App Rating: 4.3

iOS App Rating: 4.7

Pros:

- Automatic investing of spare change.

- Diversified portfolios based on risk tolerance.

- Retirement and family account options.

Cons:

- Subscription required for most features.

- Limited investment control.

- No individual stock purchases.

-

Robinhood

Robinhood is an app like MoneyLion that allows users to buy and sell stocks, ETFs, options, and cryptocurrencies directly from their mobile devices. Robinhood also offers cash management services and the ability to earn interest on uninvested cash. The app’s mission is to democratize finance by providing everyone with access to the financial markets.

Android App Rating: 3.8

iOS App Rating: 4.1

Pros:

- Commission-free trading.

- Real-time market data.

- Easy-to-use interface.

Cons:

- Limited customer support.

- No retirement accounts.

- Controversies around trade restrictions.

-

Empower

![]()

Empower is a financial management app that helps users budget, save, and track their spending. This app provides cash advances to avoid overdrafts and offers personalized financial advice through in-app messaging. It’s designed to give users control over their finances with minimal effort.

Android App Rating: 4.4

iOS App Rating: 4.8

Pros:

- Automatic savings based on spending habits.

- Cash advances to avoid overdrafts.

- Personalized financial advice.

Cons:

- Subscription required for premium features.

- Limited to U.S. residents.

- No investment options.

-

Cleo

Cleo is an AI-powered financial assistant that helps users manage their money through a conversational interface. The app connects to your bank accounts and provides insights into your spending habits, budgets, and savings. It also offers features like cash advances, savings challenges, and personalized financial tips to help users stay on top of their finances.

Android App Rating: 4.2

iOS App Rating: 4.6

Pros:

- Fun, AI-powered financial assistant.

- Cash advances and savings challenges.

- Engaging, conversational interface.

Cons:

- Limited to English-speaking users.

- Some features require a subscription.

- No traditional banking or investment services.

-

NerdWallet

NerdWallet is a personal finance application that offers users resources and guidance to help them make knowledgeable financial choices. Users can compare products, read expert reviews, and get personalized recommendations based on their financial situation.

Android App Rating: 4.3

iOS App Rating: 4.8

Pros:

- Comprehensive financial product comparisons.

- Personalized recommendations.

- Credit score tracking.

Cons:

- Heavy on ads and promotions.

- Limited direct financial services.

- Requires linking multiple accounts for full insights.

-

Truebill

![]()

Truebill is a financial management app that helps users take control of their subscriptions and reduce unwanted expenses. The app automatically identifies and tracks all of your recurring subscriptions, allowing you to cancel services directly through the app. Also, the app provides insights into your spending and tools for budgeting and saving.

Android App Rating: 4.5

iOS App Rating: 4.7

Pros:

- Automatic subscription tracking and cancellation.

- Bill negotiation services.

- Budgeting and spending insights.

Cons:

- Subscription required for premium features.

- Bill negotiation success varies.

- Limited to U.S. residents.

-

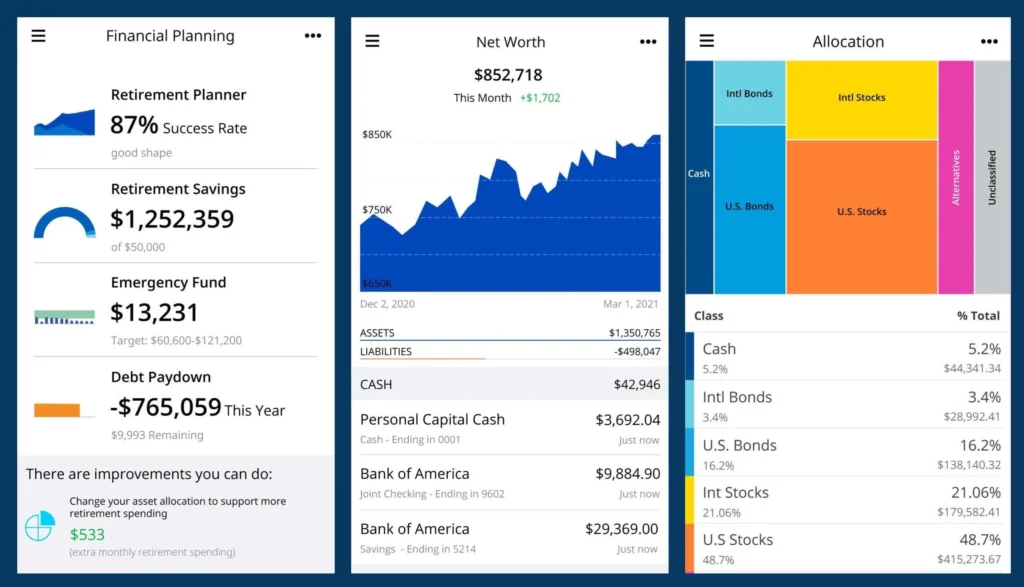

Personal Capital

Personal Capital is a wealth management app that combines financial tracking with investment management. The app offers tools for tracking your net worth, monitoring your investment portfolio, and planning for retirement. Personal Capital also provides access to financial advisors and personalized investment strategies for users looking to grow their wealth.

Android App Rating: 4.4

iOS App Rating: 4.7

Pros:

- Comprehensive financial tracking.

- Personalized investment advice.

- Retirement planning tools.

Cons:

- High minimum balance for wealth management services.

- Complex interface for beginners.

- Limited banking services.

-

Honeydue

Honeydue is a budgeting application created for couples to collaboratively oversee their finances. It allows partners to link their bank accounts, credit cards, loans, and investments in one place, making it easier to track spending and set joint budgets. Honeydue fosters financial transparency and collaboration between couples, helping them achieve their financial goals together.

Android App Rating: 4.2

iOS App Rating: 4.6

Pros:

- Designed specifically for couples.

- Joint budgeting and expense tracking.

- Bill reminders and financial chat features.

Cons:

- Limited investment options.

- No direct banking services.

- Only supports linked accounts.

-

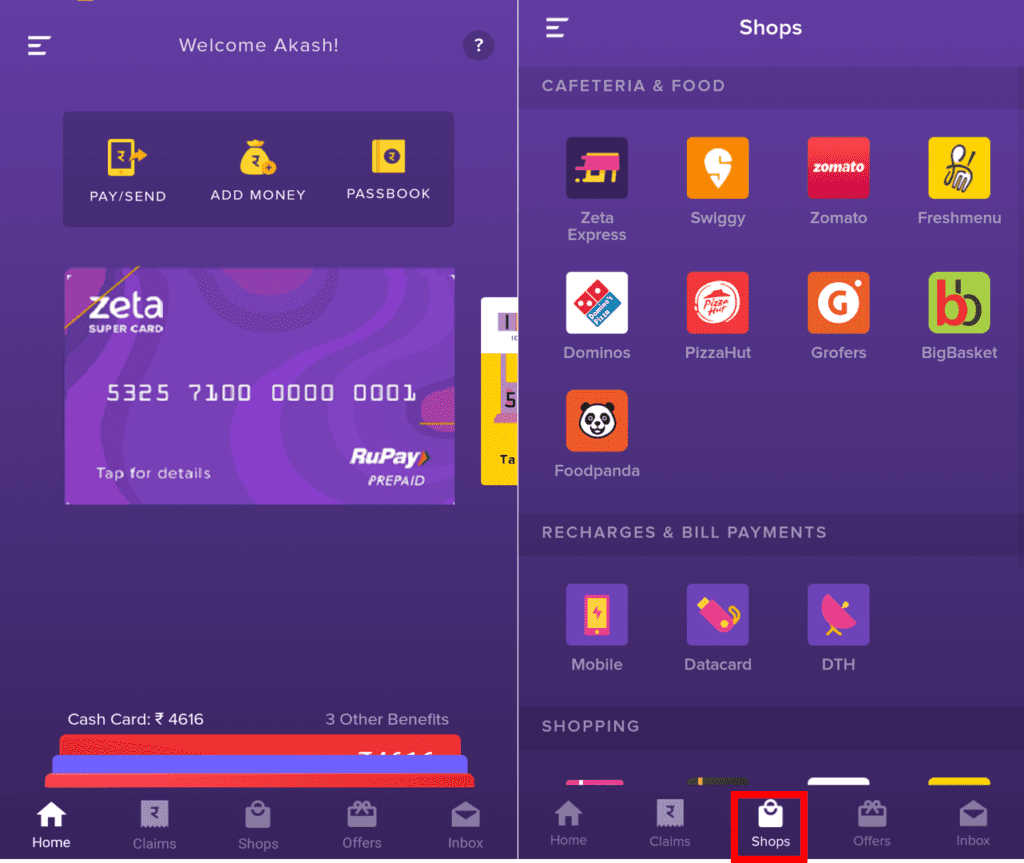

Zeta

Zeta is another financial application designed specifically for couples, providing joint banking capabilities along with budgeting tools. Couples can manage shared expenses, set budgets, track bills, and see a combined financial picture, including joint and individual accounts. Zeta also provides tools for splitting expenses and tracking financial goals..

Android App Rating: 4.3

iOS App Rating: 4.6

Pros:

- Joint and individual account tracking for couples.

- Expense splitting and budgeting tools.

- Free to use.

Cons:

- No direct banking services.

- Limited to English-speaking users.

- Some features may overlap with other apps.

-

GoodBudget

GoodBudget is a budgeting app based on the envelope budgeting system, where users allocate portions of their income into different digital “envelopes” for specific spending categories like groceries, rent, and entertainment. The app helps users track their spending and manage their finances with intention, ensuring they don’t overspend in any category.

Android App Rating: 4.6

iOS App Rating: 4.7

Pros:

- Envelope budgeting system for effective money management.

- Syncs across multiple devices for shared budgets.

- Ideal for users who prefer hands-on budgeting.

Cons:

- Manual entry required for some transactions.

- Limited to budgeting, no banking services.

- Free version has limited envelopes.

-

Simple

Simple is a mobile banking app that combines traditional banking with powerful budgeting tools. Users could create goals and set aside money in “Safe-to-Spend” categories, helping them manage their finances more effectively. The app offers immediate notifications about spending and account balances, helping users effectively manage their financial objectives.

Android: 4.1

iOS: 4.5

Pros:

- Goal-based budgeting with “Safe-to-Spend” categories.

- Real-time spending updates.

- Easy-to-use interface.

Cons:

- Discontinued service (app is no longer available).

- No longer supported by BBVA.

- Features have been absorbed into other banking apps.

-

PayActiv

PayActiv is a financial wellness app that offers employees early access to earned wages before their payday. Users can access a portion of their earned wages to cover expenses or emergencies, avoiding payday loans or overdraft fees. This app like MoneyLion also provides tools for budgeting, saving, and paying bills directly from the app. It’s a popular solution for businesses looking to offer financial benefits to their employees, helping them reduce financial stress and improve their financial well-being.

Android App Rating: 4.2

iOS App Rating: 4.5

Pros:

- Early wage access before payday.

- Budgeting and savings tools.

- Bill payment directly through the app.

Cons:

- Limited to employees of participating companies.

- No investment options.

- Fees for some features.

-

OneMain Financial

OneMain Financial is an app that provides personal loans to individuals with a range of credit scores. The app allows users to apply for loans, manage their accounts, and make payments directly from their mobile devices. OneMain Financial specializes in offering unsecured and secured loans, with personalized loan options based on the borrower’s financial situation. It’s a reliable option for users who need quick access to funds for various financial needs.

Android App Rating: 4.5

iOS App Rating: 4.7

Pros:

- Personal loans available to a wide range of credit scores.

- Secured and unsecured loan options.

- Manage loans and payments through the app.

Cons:

- Higher interest rates compared to traditional loans.

- Origination fees apply.

- No banking or savings options.

-

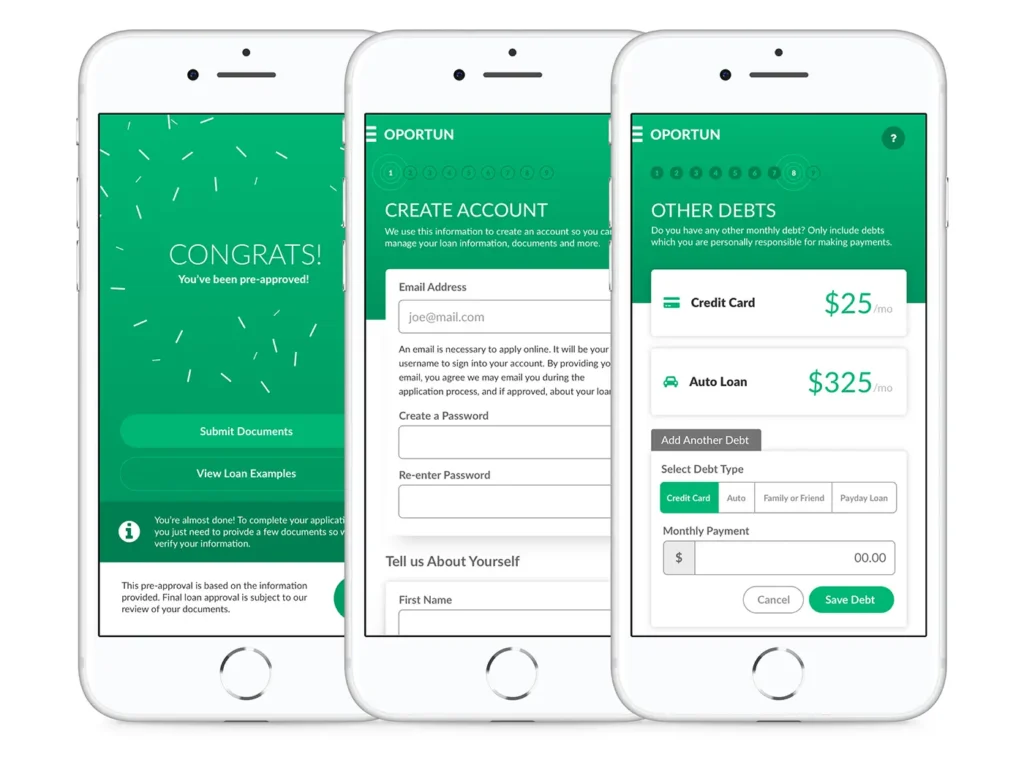

Oportun

Oportun is a financial services application that provides personal loans and credit cards specifically designed for individuals who have little to no credit history. The app allows users to apply for loans, track payments, and manage their accounts.

Android: 4.4

iOS App Rating: 4.6

Pros:

- Loans for individuals with limited credit history.

- Helps build or repair credit.

- Manage loans and payments in the app.

Cons:

- Higher interest rates than traditional loans.

- Loan amounts are limited.

- No banking or investment options.

-

Possible Finance

Possible Finance provides small, short-term loans intended to serve as an alternative to MoneyLion app. The app allows users to apply for loans and receive funds quickly, with repayment plans that are more flexible than traditional payday loans. The app is geared towards users who need immediate financial assistance and want to avoid high-interest payday loans.

Android App Rating: 4.5

iOS App Rating: 4.8

Pros:

- Small, short-term loans as an alternative to payday loans.

- Flexible repayment plans.

- Payments reported to credit bureaus to build credit.

Cons:

- Higher interest rates than traditional loans.

- Limited loan amounts.

- No banking or savings options.

-

Klover

Klover is a financial application that offers users cash advances without interest, determined by their earnings. The app analyzes the user’s spending patterns and income to determine how much they can borrow, with no hidden fees or credit checks. It is a popular choice for users who need quick access to cash without the burden of interest or fees.

Android App Rating: 4.2

iOS App Rating: 4.7

Pros:

- Interest-free cash advances based on earnings.

- No credit checks or hidden fees.

- Budgeting tools and financial insights.

Cons:

- Limited to U.S. residents.

- Cash advance amounts may be low.

- Subscription required for premium features.

-

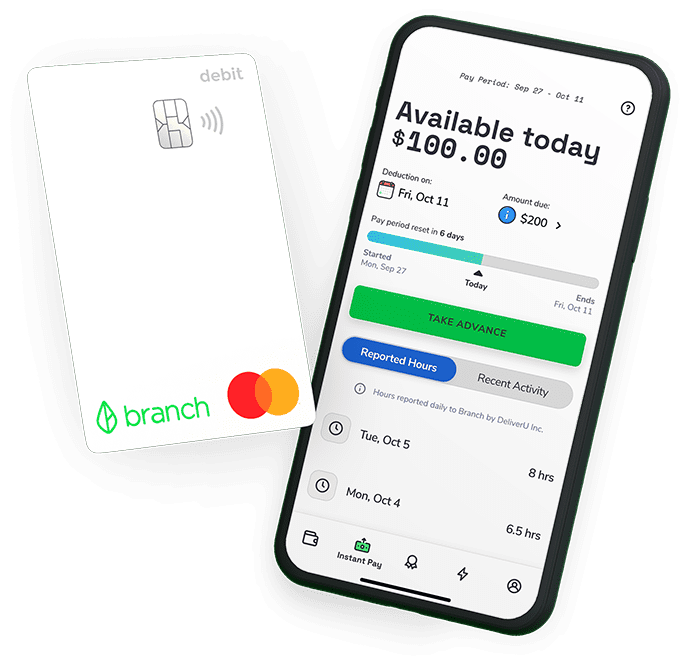

Branch

Branch is a workforce management app that offers financial services, including early wage access, budgeting tools, and fee-free banking. Branch is widely used by companies to provide financial wellness benefits to their employees, helping them manage their cash flow and reduce financial stress.

Android: 4.6

iOS: 4.7

Pros:

- Early wage access for employees.

- Budgeting tools and fee-free banking.

- Widely used by companies as an employee benefit.

Cons:

- Limited to employees of participating companies.

- No investment options.

- Some features may require employer participation.

Basic Features to Consider for Apps like MoneyLion

These were the famous top 30 apps like MoneyLion that provide instant cash in advance. However, if you are a business looking to hire best mobile app developers for finance apps, then you can first look into the important features for these apps for a cost-effective approach.

- Fintech Expertise:

Mobile app developers should have a deep understanding of financial technology, including payment gateways, secure transactions, and regulatory compliance. This ensures the app will meet the stringent security and functionality requirements of a financial platform.

- User Experience Design:

Prioritize developers who excel in creating intuitive and user-friendly interfaces. A seamless, easy-to-navigate app is essential for retaining users, especially in the competitive fintech space.

- Security Measures:

Ensure the development team is well-versed in implementing robust security protocols, such as encryption, two-factor authentication, and secure data storage, to protect sensitive financial data from potential breaches.

- Scalability:

The application should be developed to accommodate future growth and increased user demand. Developers must be capable of designing a system architecture that can handle a growing user base and additional features without compromising performance.

- API Integration:

The ability to integrate with various third-party APIs (e.g., for banking services, identity verification, and credit scoring) is crucial. This allows the app to offer comprehensive financial services and enhance user experience.

Conclusion

While cash advance apps like MoneyLion offer quick financial relief, it is essential to recognize that relying on loans should not be your go-to solution for managing finances. Regularly borrowing money, even from apps with favorable terms, can lead to long-term financial challenges. Therefore, it is important if you develop a habit of managing your expenses within a set budget to avoid unnecessary debt. If you find yourself needing financial assistance, take a moment to evaluate your spending habits and consider alternative strategies for saving and budgeting.

As a business, whether you need fast-pacing apps like MoneyLion for Android or iOS app development, then you can come to AlgoRepublic for it. We offer highly-advanced mobile apps with the help of our most proficient mobile app developers. So, if you are in the market for a mobile app development company that understands the complexities of financial technology, look no further than AlgoRepublic. Let’s build something great together!

FAQs:

MoneyLion is a financial technology app that provides users with access to personal loans, cash advances, budgeting tools, and investment services, helping users manage their finances and build credit.

To qualify for a cash advance or loan, users typically need to meet certain criteria, such as a minimum income level, a valid bank account, and a good credit history. Each app may have specific requirements, so it's essential to check their guidelines.

While many apps like MoneyLion offer fee-free services, some may charge monthly membership fees, late payment fees, or fees for certain features like expedited payments. It's important to review the fee structure before using the app.

The cash advance feature allows users to access a portion of their earned wages before their payday. Users request an advance through the app, which is typically deducted from their next paycheck. Some apps may charge a small fee or interest, while others offer interest-free advances.

Reputable apps like MoneyLion prioritize user security and implement measures such as encryption, secure data storage, and two-factor authentication to protect personal and financial information. However, it's essential to review each app's privacy policy and security practices before using their services.

Popular alternatives include Instagram, which offers similar Stories and filters, and TikTok, known for its short-form video content and effects.