Table of Contents

Paying for everything monthly or even daily seems like a difficult task somehow. Imagine you are in a restaurant and forget to bring your wallet. Now would you go back and get it or would you rather stay there and pay through apps like Venmo? Well, that is where these apps come in demand for easy money transfer and management even if you have a busy schedule.

Venmo and payment apps like Venmo are popular choices and very common nowadays.

This shows an ultimate technological advancement which is also a great success in 2024.

In this blog, we have some amazing apps like Venmo which you can use locally and even globally for money management and transferring to your friends or family.

Moreover, if you are a startup or a small business looking for a mobile app development company to get an app like Venmo, then you can also go through this blog and read about these apps’ features along with their pros and cons.

What is Venmo and How Does it Work?

Venmo is a popular mobile payment app that makes it easy to send and receive money between friends, family, and businesses. Whether you are dividing a dinner bill, settling rent, or making online purchases, Venmo enables you to swiftly send money with just a few taps. The app integrates seamlessly with your bank account or debit card, and its social feed lets you see and comment on transactions, adding a fun and social element to payments.

Features:

- Peer-to-Peer Payments: Quickly send and receive money between friends and family with ease.

- Social Feed: Share payments with your network and add comments or emojis.

- In-App Purchases: Pay directly within apps and online stores using Venmo.

- Venmo Card: Use the Venmo Debit Card to spend your balance anywhere Mastercard is accepted.

Pros:

- Quick and easy payments

- Social features add a fun element

- No fees for bank or balance transfers

- Widely accepted for in-app purchases

Cons:

- Limited to the U.S.

- Fees for instant transfers to bank accounts

- Potential privacy concerns with the social feed

- No buyer protection for purchases

Venmo Alternatives Which You Can Try

PayPal

![]()

PayPal is a digital Venmo-like appcash that allows you to send, receive, and manage money securely from anywhere in the world. Whether you are shopping online or splitting a bill with friends, PayPal makes it easy to move money with just an email address or phone number.

Features:

- Secure online payments

- Peer-to-peer transfers

- Supports multiple currencies

- Integration with e-commerce platforms

Pros:

- Widely accepted

- Strong buyer protection

- Easy to use

- Fast transactions

Cons:

- High fees for international transfers

- Dispute resolution can be slow

- Account freezing issues

- Limited customer support

Rating: 4.2

Cash App

Cash App is one of the other apps like Venmo that allows you to send and receive money instantly with friends and family. With added features like direct deposits and Bitcoin trading, it is more than just a peer-to-peer payment app—it is your go-to financial hub.

Features:

- Peer-to-peer payments

- Cash Card for purchases

- Bitcoin trading

- Direct deposit option

Pros:

- No fees for basic transfers

- User-friendly interface

- Supports stock and Bitcoin investments

- Instant transfers available

Cons:

- Limited availability outside the US

- Lower security features

- Limited customer support

- No purchase protection

Rating: 4.3

Zelle

Zelle is a fast, fee-free way to send money directly between U.S. bank accounts. Integrated into most banking apps, Zelle makes it simple to split expenses or pay back friends instantly without needing any extra downloads.

Features:

- Direct bank transfers

- Instant transfers

- No fees for sending/receiving

- Integrated with many banking apps

Pros:

- Fast transfers

- No fees

- Secure bank integration

- No need for additional apps

Cons:

- Limited to the US

- No purchase protection

- Linked to a bank account

- Lack of dispute resolution options

Rating: 4.0

Google Pay

Google Pay is a digital wallet app like Venmo that lets you make payments online, in-store, and even peer-to-peer. With just a tap on your phone, you can pay for groceries, send money to a friend, or manage your loyalty cards—all securely stored in one place.

Features:

- Mobile payments

- Peer-to-peer transfers

- Loyalty cards and tickets integration

- Supports in-app and online payments

Pros:

- Secure with encryption

- Wide acceptance

- Easy integration with Google services

- No fees for basic transactions

Cons:

- Limited features in some countries

- Requires a smartphone

- Issues with some banks

- Customer support can be slow

Rating: 4.2

Apple Pay

Apple Pay turns your iPhone into a secure wallet, allowing you to make contactless payments in stores, apps, and online. With built-in privacy and no need to carry physical cards, paying with Apple Pay is as simple as a touch or glance.

Features:

- Mobile payments

- Peer-to-peer transfers

- Secure with Face/Touch ID

- Supports online and in-app purchases

Pros:

- Highly secure

- Quick and easy payments

- Widely accepted in stores

- No fees for basic transactions

Cons:

- Limited to Apple devices

- Not available in all countries

- Limited customer support

- Dependency on NFC technology

Rating: 4.7

Square Cash

Square Cash, also known as Cash App, is one of the payment apps like Venmo for instant money transfers, whether you are paying back a friend or shopping online. It also offers a Cash Card for spending your balance anywhere Visa is accepted, all while making investing in stocks or Bitcoin accessible.

Features:

- Peer-to-peer payments

- Cash Card for purchases

- Business payment processing

- Direct deposit

Pros:

- No fees for personal transfers

- User-friendly

- Quick deposits to bank accounts

- Option to invest in stocks/crypto

Cons:

- Fees for instant deposits

- Limited availability outside the US

- Security concerns

- No purchase protection

Rating: 4.3

Samsung Pay

Samsung Pay is a mobile payment solution that works with just about any payment terminal, thanks to its unique MST technology. With a simple swipe up from your home screen, you can make secure payments, store loyalty cards, and even send money to friends.

Features:

- Mobile payments

- MST and NFC technology

- Loyalty cards and rewards integration

- Peer-to-peer transfers

Pros:

- Wide acceptance due to MST

- Secure with Samsung Knox

- No fees for basic transactions

- Works with older payment terminals

Cons:

- Limited to Samsung devices

- Not supported in all countries

- Slow customer support

- Limited third-party app integration

Rating: 4.4

Facebook Pay

Facebook Pay is a seamless payment option integrated across Facebook, Messenger, Instagram, and WhatsApp. Whether you are shopping, donating, or splitting the bill, Facebook Pay lets you handle transactions securely without leaving the app.

Features:

- Peer-to-peer payments

- Integration with Facebook, Messenger, Instagram

- Supports donations

- Easy setup with debit/credit cards

Pros:

- Seamless integration with social media

- No fees for personal transactions

- Easy to use

- Secure with Facebook’s infrastructure

Cons:

- Limited to Facebook apps

- Privacy concerns

- Limited international availability

- Customer support issues

Rating: 4.0

Revolut

Revolut is also an alternative for apps like Venmo and Cash App that makes it easy to manage your money, from everyday spending to currency exchange and cryptocurrency trading. Whether you are paying friends, shopping abroad, or budgeting, Revolut keeps everything in one place with real-time updates.

Features:

- Multi-currency accounts

- Peer-to-peer payments

- Cryptocurrency trading

- Budgeting tools

Pros:

- Competitive exchange rates

- Wide range of features

- No fees for basic transactions

- Supports international payments

Cons:

- Monthly fee for premium features

- Limited customer support

- Complex fee structure

- Account freezing issues

Rating: 4.8

Wise

Wise, previously known as TransferWise, is an international money transfer service that enables you to send money overseas at the real exchange rate, accompanied by low and transparent fees. Ideal for expats, freelancers, and travelers, Wise makes moving money across borders as easy as sending an email.

Features:

- Low-cost international transfers

- Multi-currency accounts

- Real exchange rates

- Business account options

Pros:

- Transparent fees

- Competitive exchange rates

- Easy to use

- Fast transfers

Cons:

- No cash deposits or withdrawals

- Limited in some countries

- No cryptocurrency support

- Customer support can be slow

Rating: 4.3

Skrill

Skrill is a digital wallet that makes online payments and international money transfers quick and easy. Whether you are shopping, trading crypto, or sending money abroad, Skrill keeps your transactions secure with just an email address.

Features:

- Digital wallet for online payments

- Low-cost international transfers

- Cryptocurrency trading

- Prepaid MasterCard

Pros:

- Low fees for transfers

- Easy account setup

- Supports multiple currencies

- Secure transactions

Cons:

- High fees for currency conversion

- Limited customer support

- Account freezing issues

- Not widely accepted

Rating: 4.1

Payoneer

Payoneer is a global payment platform designed for freelancers and businesses to receive payments and manage funds internationally. With multi-currency accounts and direct bank withdrawals, it is your passport to global commerce.

Features:

- Global payment services

- Multi-currency accounts

- Prepaid MasterCard

- Mass payouts for businesses

Pros:

- Supports multiple currencies

- Widely used for freelancing

- Competitive exchange rates

- Easy to withdraw to local banks

Cons:

- High fees for some transactions

- Limited customer support

- Account maintenance fees

- Slow account setup

Rating: 4.5

Xoom

Xoom, a service by PayPal, allows you to send money, pay bills, and reload phones for loved ones abroad. Whether it is cash pickup or direct bank deposits, Xoom delivers your funds fast and securely around the globe.

Features:

- International money transfers

- Bill payments

- Cash pickup options

- Integration with PayPal

Pros:

- Fast transfers

- Easy integration with PayPal

- Cash pickup available

- Secure transactions

Cons:

- High fees for small amounts

- Limited to certain countries

- Exchange rate markup

- Limited customer support

Rating: 4.5

Remitly

Remitly specializes in international money transfers, making it easy to send money to friends and family abroad. With multiple delivery options, including bank deposits and cash pickup, Remitly offers a secure and affordable way to support loved ones across borders.

Features:

- Low-cost international transfers

- Cash pickup options

- Multiple delivery speeds

- Mobile app available

Pros:

- Competitive exchange rates

- Fast transfers

- Easy to use

- Secure with 24/7 support

Cons:

- Limited to certain countries

- Fees for fast transfers

- No multi-currency accounts

- Limited services compared to competitors

Rating: 4.5

WorldRemit

WorldRemit is an online money transfer service that offers fast, secure transfers to over 150 countries. Whether you are sending money for cash pickup, mobile money, or bank deposits, WorldRemit makes global remittances accessible and affordable.

Features:

- Low-cost international transfers

- Mobile top-up services

- Cash pickup options

- Multi-currency support

Pros:

- Competitive exchange rates

- Fast transfers

- Easy to use

- Multiple delivery options

Cons:

- Limited to certain countries

- Fees for some transfers

- Complex fee structure

- Limited customer support

Rating: 4.6

Chime

Chime is a mobile banking app that offers fee-free accounts with early direct deposit and automatic savings. With no overdraft fees and a user-friendly app, Chime simplifies banking and makes managing your money a breeze.

Features:

- Mobile banking with no fees

- Early direct deposit

- Automatic savings features

- No overdraft fees

Pros:

- No hidden fees

- User-friendly app

- Early access to paycheck

- Automatic savings options

Cons:

- Limited customer support

- No physical branches

- Limited to the US

- No joint accounts

Rating: 4.5

Azimo

Azimo is an international money transfer service that lets you send money to over 200 countries. With low fees and fast delivery options, Azimo is a convenient and secure way to support friends and family worldwide.

Features:

- Low-cost international transfers

- Cash pickup options

- Multi-currency support

- Mobile app available

Pros:

- Competitive exchange rates

- Fast transfers

- Easy to use

- Secure with 24/7 support

Cons:

- Limited to certain countries

- Complex fee structure

- No cryptocurrency support

- Limited customer support

Rating: 4.3

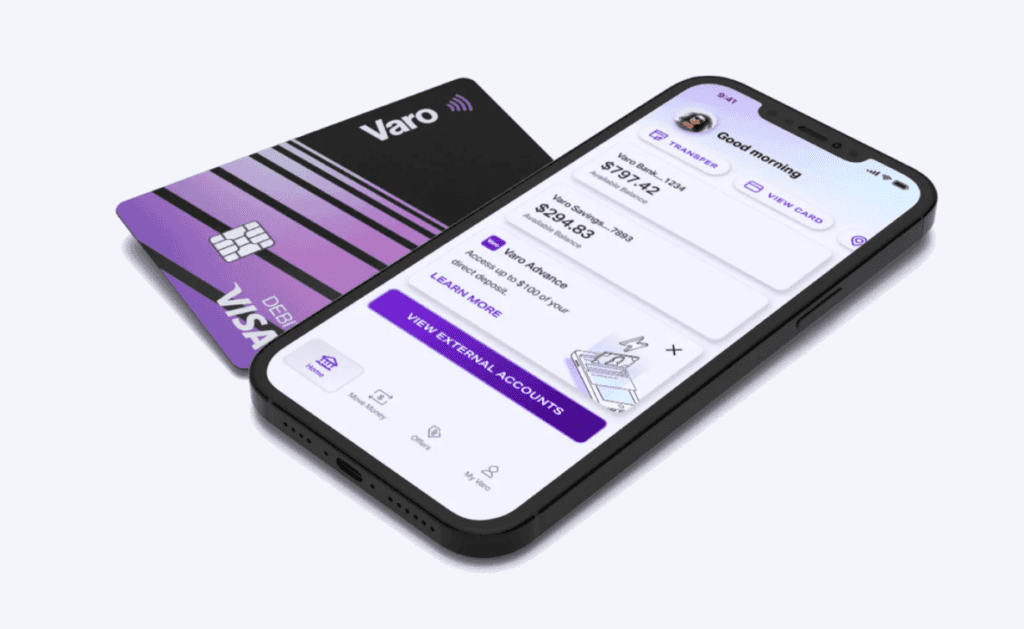

Varo

Varo is a mobile bank that offers fee-free checking and savings accounts, with benefits like early direct deposit and high-yield savings. Designed for simplicity and transparency, Varo helps you manage your money without the hassle of traditional banks.

Features:

- Mobile banking with no fees

- Early direct deposit

- High-yield savings account

- No overdraft fees

Pros:

- No hidden fees

- User-friendly app

- High savings interest rates

- Early access to paycheck

Cons:

- Limited customer support

- No physical branches

- Limited to the US

- Limited services compared to traditional banks

Rating: 4.6

Popmoney

Popmoney is a peer-to-peer payment service that allows you to send money directly from your bank account to someone else’s. With no need for a separate app, Popmoney makes it easy to split bills or pay back friends with just a few clicks.

Features:

- Peer-to-peer payments

- Integration with banks

- No need for separate app

- Easy account setup

Pros:

- Integrated with many banks

- No need for additional apps

- Secure transactions

- No fees for receiving money

Cons:

- Limited to the US

- Fees for sending money

- No purchase protection

- Slow transfers compared to competitors

Rating: 3.8

Dwolla

Dwolla is a payment platform that enables businesses to send and receive funds via ACH transfers in the U.S. With a focus on low-cost, secure transactions, Dwolla provides a flexible API for businesses to manage payments at scale.

Features:

- ACH payments

- Low-cost transfers

- API for businesses

- Mass payouts

Pros:

- Low fees

- Easy integration with business apps

- Secure transactions

- Scalable for businesses

Cons:

- Limited to the US

- No consumer-facing app

- Slow transfers

- Limited customer support

Rating: 4.0

Payza

Payza is an online payment platform that supports international money transfers and cryptocurrency transactions. With a focus on security and ease of use, Payza offers a versatile solution for both personal and business payments.

Features:

- Digital wallet for online payments

- Low-cost international transfers

- Cryptocurrency support

- Prepaid cards available

Pros:

- Supports multiple currencies

- Cryptocurrency-friendly

- Secure transactions

- Easy to use

Cons:

- Limited customer support

- High fees for some transactions

- Account freezing issues

- Not widely accepted

Rating: 3.7

Wave

Wave is a mobile banking and financial management app designed for small businesses and freelancers. With free invoicing, accounting tools, and no-fee banking, Wave simplifies managing your business finances all in one place.

Features:

- Mobile banking with no fees

- Free invoicing and accounting tools

- Credit card processing

- Instant payouts

Pros:

- No hidden fees

- User-friendly interface

- Integrated accounting tools

- Fast payouts

Cons:

- Limited customer support

- No physical branches

- Limited to the US

- No loan services

Rating: 4.8

Snapcash

Snapcash is a person-to-person payment feature within Snapchat that allows users to send money to friends quickly and securely. Integrated into the Snapchat app, Snapcash made paying back friends as easy as sending a snap.

Features:

- Peer-to-peer payments

- Integration with Snapchat

- Secure with debit card linkage

- Easy account setup

Pros:

- Easy to use within Snapchat

- No fees for sending money

- Secure transactions

- Fast transfers

Cons:

- Limited to Snapchat users

- No purchase protection

- Privacy concerns

- Limited customer support

Rating: 4.0

Circle Pay

Circle Pay is a payment service that lets you send and receive money instantly, with support for multiple currencies. Designed to be social and secure, Circle Pay made moving money as simple as sending a text.

Features:

- Peer-to-peer payments

- Supports multiple currencies

- Mobile app available

- No fees for basic transactions

Pros:

- Easy to use

- No fees for basic transfers

- Supports multiple currencies

- Secure transactions

Cons:

- Limited availability in some countries

- No business accounts

- No cryptocurrency support

- Customer support issues

Rating: 4.0

Western Union

Western Union is a global leader in money transfers, offering a range of options including cash pickup, bank deposits, and mobile wallets. With a vast network of locations worldwide, Western Union makes it easy to send money to friends and family, wherever they are.

Features:

- Global money transfers

- Cash pickup options

- Bill payments

- Mobile app available

Pros:

- Widely available worldwide

- Multiple delivery options

- Secure transactions

- Fast transfers

Cons:

- High fees for some transfers

- Complex fee structure

- Exchange rate markup

- Limited customer support

Rating: 4.5

Key Features to Consider Before Choosing the Right App Like Venmo

Payment and transfer money apps are available widely now. However, this blog is for you to research about features and tools of these apps like Venmo. If you want to get scalable mobile app development services for alternative apps like Venmo, then you need to first find out some important features. These features are good to go for every payment app and are eligible for seamless operation.

Security & Privacy:

Look for apps with robust encryption, two-factor authentication, and privacy controls to protect your financial information.

Transaction Fees:

Compare the fees for sending, receiving, and transferring money, especially for instant transfers or international payments.

Ease of Use:

The app should have a user-friendly interface, making it easy to send and receive money quickly and without hassle.

Compatibility:

Ensure the app works seamlessly with your bank, credit card, or other payment methods and is available on your preferred devices (iOS, Android, etc.).

Transfer Speed:

Check how fast money transfers occur, both within the app and when moving funds to your bank account.

Social Features:

If you enjoy the social aspect of Venmo, find an app that offers similar features like transaction feeds, comments, and emojis.

Global Reach:

If you need to send money internationally, choose an app with wide geographic coverage and competitive exchange rates.

Customer Support:

Reliable customer service is essential in case of issues with transactions or account management.

Additional Features:

Consider extras like budgeting tools, bill splitting, or cryptocurrency support, depending on your financial habits.

Which is the Best Venmo Like Cash App?

You cannot keep using Venmo or the same apps like Venmo forever due to their limitations in the features. However, you can still find some factors that are based on providing the best app results. These are the factors that any proficient mobile app developer can create using innovative features and tools.

User Experience and Interface: A clean, intuitive design is crucial for ease of use. The app should enable quick navigation for sending and receiving money, checking balances, and managing transactions without unnecessary complexity.

Transaction Fees: Assess the app’s fee structure for various transactions, including sending money, receiving funds, and instant transfers. Ideally, the best app should have low or no fees for standard transactions to maximize your savings.

Transfer Speed: Look at how quickly the app processes transactions. The best alternatives to Venmo should offer instant transfers or same-day transactions, especially for urgent payments, while ensuring a seamless experience for both senders and receivers.

Security Features: Strong security measures are essential to protect your financial data. Check for features like encryption, two-factor authentication, and fraud protection to ensure that your transactions and personal information remain safe.

Additional Features: Consider any extra functionalities that can enhance your experience, such as direct deposit options, cryptocurrency trading, spending with a debit card, or budgeting tools. These features can add significant value and make the app more versatile for your financial needs.

Conclusion

Nowadays, there are thousands of mobile apps for retail, real estate, healthcare, or even food delivery services for the latest business approach. Similarly, these finance apps like Venmo are convenient as you can even use them locally and globally by paying a little fee. They provide a convenient, efficient, and secure way to send and receive money, making financial interactions seamless among friends, family, and even businesses.

With features like instant transfers, social engagement, and integration with other financial tools, these payment apps have become essential for managing everyday expenses and supporting small businesses.

If you are looking to develop similar innovative payment solutions for Android and iOS app development, then contact AlgoRepublic. Our expertise in mobile app development services can help you create user-friendly, secure, and efficient payment applications tailored to your business needs. Let us bring your vision to life!

FAQs:

A Venmo app is a mobile payment service that allows users to send and receive money easily and quickly, often with social features that let you share transactions with friends and family.

Most reputable payment apps use encryption and security features like two-factor authentication to protect your personal and financial information. Always check the security measures of the app you choose.

Many apps offer free standard transactions, but some may charge fees for instant transfers, credit card payments, or international transactions. Review the fee structure before using the app.

While some apps allow international payments, others may be limited to domestic use. Check the app's coverage and capabilities if you need to send money abroad.

Most payment apps allow you to link your bank account or debit/credit card by entering your account information within the app. Some may require verification through small test deposits.

Many apps are designed for personal use but some, like Cash App and PayPal, offer features for businesses, such as invoicing and payment processing. Check the app’s terms and conditions for business use.

Focus on intuitive user interface (UI) and user experience (UX) design. Ensure the app is easy to navigate, with a clear layout and minimal steps to complete bookings. Conduct user testing and gather feedback to refine the design and functionality.

Yes, many payment apps impose limits on transaction amounts, especially for unverified accounts. Limits can vary based on verification status and account type.

Transfer speeds vary by app. Standard transactions may take a few business days, while instant transfers can occur within minutes, depending on the app and your bank.

Most apps have customer support options, including in-app chat, email, or phone support. Contact the support team for assistance with transaction issues or account problems.

Some apps allow you to cancel payments if they haven’t been accepted by the recipient. However, once a payment is processed, it typically cannot be reversed. Check the app’s policy for specifics.